A Step-by-Step Guide: How to Build a Trading Bot

Building a trading bot can be an exciting and rewarding endeavor, enabling you to execute trades with precision and efficiency. By harnessing the power of automation, you can potentially enhance your trading performance and capitalize on market opportunities in real-time.

In this guide, we will walk you through the step-by-step process of creating a trading bot. Whether you're an experienced trader looking to automate your strategies or a beginner curious about the possibilities of AI in trading, this blog is designed to equip you with the knowledge to build your own trading bot.

What Are Trading Bots and How do They Work?

In simple terms, trading bots, algorithm bots, or algo bots are automated programs that follow predetermined rules defined by the traders and execute trades in financial markets on behalf of the individual investor or the trader.

Trading bots are becoming imprtant. According to a report from Analyzing Alpha, equities are likely to contribute $8.61 billion in the algo trading market share in 2027.

It follows an automated computer-driven algorithmic and systematic trading approach devoid of any biases that humans bring and has the following key capabilities.

- A strategy that triggers a trading signal, and based on the trading signal, it places orders in the cryptocurrency markets or brokerage exchanges.

- Consumes historical and current market data, social media feeds, news, and other relevant data to perform data analyses.

- It manages and keeps track of an account's essential positions, including the average price, units, and other relevant details.

- Performs basic risk management, alerting, and monitoring.

At its core, a trading bot has three primary predetermined rules. The first is the entry rule, which guides when to buy and sell commodities. The second is the exit rule, which directs when to close a current position. Finally, there is the position sizing rule, which signals the quantities to buy or sell.

How to Build a Trading Bot?

Building trading bots involves several steps, including defining your strategy, setting up necessary infrastructure, coding the bot, and testing the bot completely. Below is the overview of the process:

1 Selecting a programming language

The pivotal step in building a trading bot is the programming language.

There are multiple languages, such as C++, Java, JavaScript, Python, etc., that help you create a trading bot; however, Python stands out for its suitability in handling extensive financial market data, including historical trading records and time series data, thanks to packages like NumPy and Pandas.

Furthermore, Python has a range of supplementary packages, including TsTables, PyTables, SQLite for data storage and retrieval, TensorFlow, scikit-learn for deep learning, and multiple additional packages that help solve fundamental and specialized use cases.

Once you've decided on a programming language, you can choose an IDE or integrated development environment, which provides a complete environment to develop, test, and debug your code.

Here’s a simplified Python code example for a basic stock trading bot. This example demonstrates how to retrieve stock data, make trading decisions based on simple moving averages (SMA), and execute buy and sell orders using the yfinance library, which allows you to access Yahoo Finance data.

Before running this code, make sure to install the yfinance library by using pip install yfinance.

import yfinance as yf

class StockTradingBot:

def __init__(self, symbol, short_window, long_window, initial_cash):

self.symbol = symbol

self.short_window = short_window

self.long_window = long_window

self.cash = initial_cash

self.stock_balance = 0

self.history = []

def get_stock_data(self, start_date, end_date):

data = yf.download(self.symbol, start=start_date, end=end_date)

return data

def calculate_sma(self, data, window):

return data['Close'].rolling(window=window).mean()

def buy(self, price, amount):

total_cost = price * amount

if self.cash >= total_cost:

self.cash -= total_cost

self.stock_balance += amount

self.history.append(f"Bought {amount} shares at ${price:.2f} each")

def sell(self, price, amount):

if self.stock_balance >= amount:

total_sale = price * amount

self.cash += total_sale

self.stock_balance -= amount

self.history.append(f"Sold {amount} shares at ${price:.2f} each")

def execute_strategy(self, data):

short_sma = self.calculate_sma(data, self.short_window)

long_sma = self.calculate_sma(data, self.long_window)

for i in range(self.long_window, len(data)):

if short_sma[i] > long_sma[i]:

# Buy signal: Short-term SMA crosses above Long-term SMA

self.buy(data['Close'][i], 10) # Example: Buy 10 shares

elif short_sma[i] long_sma[i]:

# Sell signal: Short-term SMA crosses below Long-term SMA

self.sell(data['Close'][i], 10) # Example: Sell 10 shares

def run(self):

data = self.get_stock_data("2022-01-01", "2023-01-01") # Adjust date range as needed

self.execute_strategy(data)

self.display_portfolio()

def display_portfolio(self):

print(f"Portfolio Summary:")

print(f"Cash: ${self.cash:.2f}")

print(f"Stock Balance: {self.stock_balance} shares")

print(f"Portfolio Value: ${(self.cash + self.stock_balance * data['Close'][-1]):.2f}")

if __name__ == "__main__":

bot = StockTradingBot(symbol="AAPL", short_window=50, long_window=200, initial_cash=10000)

bot.run()

Please note that this code is a simplified example for educational purposes and should not be used for actual trading without further development, risk management, and consideration of real-world market conditions. It's essential to thoroughly research and understand stock trading, including risks and regulations, before implementing a trading bot in a real trading environment.

2 Choose your trading platform and the asset you want to trade

Knowing the programming language is one thing, but knowing where to trade your assets is also vital.

You must first pick which financial asset class you will trade in before settling on an exchange platform: equities or stocks, bonds, commodities, foreign exchange, cryptocurrency, etc.

The second critical point is whether your trading bot can communicate with the exchange via its Public API and whether you are legally permitted to trade on that exchange for that specific financial asset.

3 Selecting the server to build your trading bot

To send requests to the Public API hosted by an exchange, you need a server; it can be a private server or a cloud hosting service such as AWS, Azure, Digital Ocean, or GCS.

Cloud hosting services are preferable since they come with many advantages, such as scalability, connectivity, location, ease of use, tech support, etc., and you do not have to worry if the server complies with the market regulations of the exchange.

4 Define your strategy

To build a trading bot, you start by defining your strategy; there are a plethora of strategies you can consider to create a trading bot, including the following or a combination of those.

- Macroeconomic indicators, such as GDP growth or inflation rates, provide critical insights for economic analysis.

- Fundamental analysis involves examining cash flow data and company reports to assess investment opportunities.

- Statistical analysis utilizes techniques like analyzing volatility patterns and regression models for data-driven decision-making.

- Technical analysis employs methods like studying moving averages and support/resistance levels to predict market trends.

- Market microstructure explores strategies like latency arbitrage and order book dynamics to gain a competitive edge.

Your chosen strategy becomes the foundation for your code since it will define the data the trading bot algorithm must refer to analyze, interpret, and execute the trades efficiently without losses or risks.

The best part about building your Trading Bot is that you can customize strategies according to your needs.

5 Integrate with the exchange API

As discussed earlier, for the trading bot to work, integration with the exchange API is a must, and this involves logging into the exchange platform to obtain the secret API key that helps you access your exchange account from the Python script.

6 Backtesting your trading bot

Now that the code is all set, the next step is to validate your code and check if your trading strategy actually works. It can be analyzed by backtesting, i.e., running your trading bot against historical data to test its efficiency or identify any potential issues with the trading bot.

- Is your logic working?

- Is your algorithm working right to generate profit or loss?

- How is it behaving in the black swan event?

You can have all these answers by backtesting the code.

7 Optimizing your trading bot

Optimization is the process of refining and improving a trading strategy based on the results of backtesting. After initial backtests, the strategy's parameters or rules can be adjusted to enhance performance.

There are different ways to optimize your trading bot, and they are as follows.

Removing the overfitting bias: Trading bots, trained on historical data, may produce results inconsistent with current trends due to overfitting bias. To reduce bias, it's crucial to eliminate irrelevant inputs and incorporate new training parameters regularly.

Check for potential risks: You can remove impending risks by incorporating risk management techniques such as setting predefined price levels at which the bot will automatically exit a trade to limit potential losses.

Take-Profit Orders: Specify price levels at which the bot will automatically exit a trade to lock in profits.

Position Sizing: Determine the appropriate size for each trade based on risk tolerance and account size, using techniques like fixed fractional position sizing or the Kelly Criterion.

Diversification: Avoid over-concentration in a single asset or strategy by diversifying across different assets, markets, or trading strategies.

Optimizing a trading bot is an ongoing process that requires careful analysis, testing, and adaptation. Remember that no trading strategy or bot is foolproof, and there are inherent risks associated with algorithmic trading. Diligence, discipline, and continuous improvement are key to successful bot optimization.

8 Forward testing

After completing all of the preceding procedures and before going live with the bot, you must run a forward test. A forward test enables the trading bot you created to paper trade with real prices for a set period of time to determine how well it works with real-time data.

9 Deploying and Monitoring Your Bot

Now, you can deploy the bot live on your preferred cloud platform or server and continuously monitor it using real-time tools. These tools provide immediate performance insights, enabling traders to track bot activities without constant platform access efficiently.

These tools ensure quick responses to market shifts and timely profit accumulation alerts, preventing missed opportunities and minimizing unexpected losses.

Monitoring your trading bots also involves consistent performance analysis over time and assessing market sentiments regularly.

Performance analysis involves scrutinizing profit/loss records across various markets and timeframes, using metrics like win rate and ROI. Backtesting under realistic conditions further optimizes bot strategies.

News monitoring via web crawlers and sentiment analysis on platforms like Twitter enables rapid adjustments to market reactions. Combining these techniques ensures effective bot deployment and continual performance enhancement in dynamic stock and crypto markets.

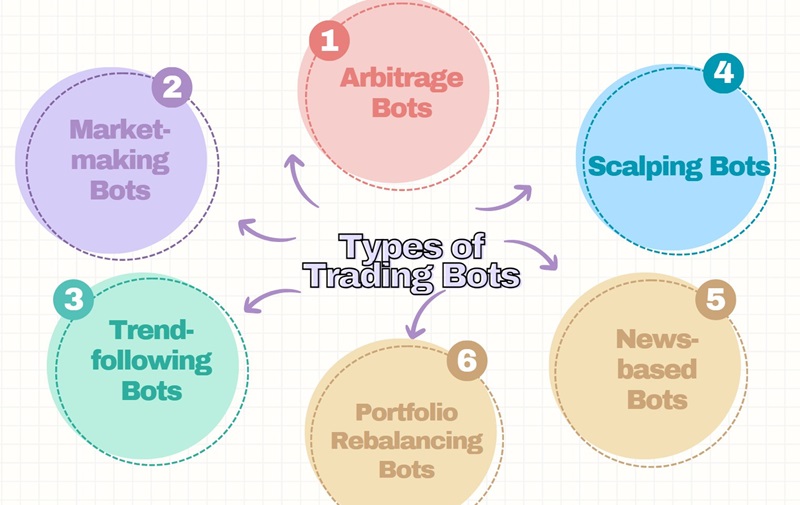

Types of Trading Bots

Generally speaking, trading bots are used in various markets, including stocks, cryptocurrencies, and forex. Here are some key types of trading bots:

Arbitrage Bots: these bots can buy an asset at a lower prices on one exchange and sell it at a higher price, exploiting prices differences to make profits.

Market-making Bots: these bots can profit from the spread to the market via offering liquidity by placing buy and sell orders.

Trend-following Bots: these bots execute trades based on direction of market trends, i.e. buying items with price arising and selling items with price downtrending.

Scalping Bots: these bots execute a large number of small trades to capture small price movements.

News-based Bots: these bots analyze new headlines and execute trades based on positive or negative news sentiment.

Portfolio Rebalancing Bots: these bots can automatically adjust the asset allocation in a portfolio to maintain a risk level.

There are also trading bots like mean reversion bots, momentum bots, statistical arbitrage bots, high-frequency trading bots, etc. Each type of trading bots operates based on different rules and goals, and traders select the bot that best suites the trading goals and risk tolerance.

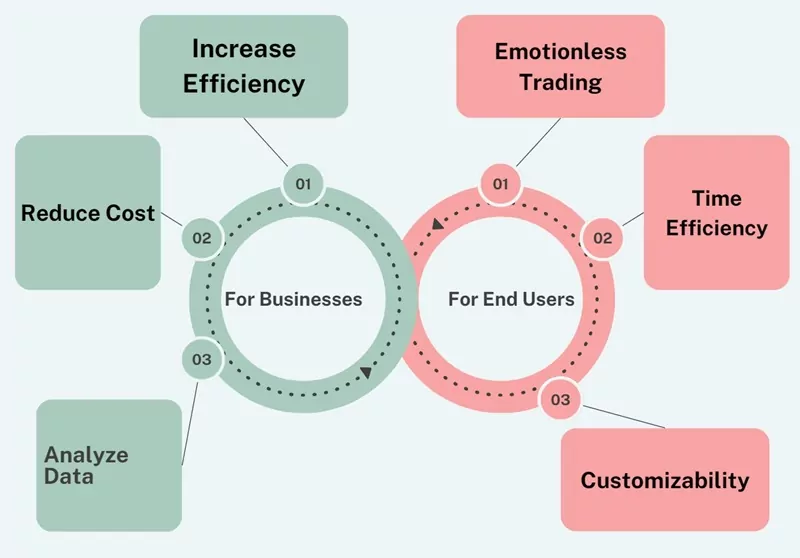

The Significance of Trading Bots

Technology advancements have significantly enhanced trading bots, enabling them to execute trades with minimal human intervention. The following are some benefits of utilizing trading bots for businesses and end users:

For Businesses:

Increase Efficiency: Trading bots can execute trades faster and more accurately, perform repetitive tasks at scale, which can significantly increase efficiency. In the U.S. equity market, European financial markets, and prominent Asian capital markets, algorithmic trading constitutes approximately 60% - 75% of the total trading volume.

Reduce Cost: By performing large amount of trades and repetitive tasks via trading bots, companies can reduce large trading members and human errors, thus cut down on salary and operational expense.

Analyze Data: Trading bots can learn from complex algorithms and machine learning to analyze data quickly.

Combining these benefits positions systematic algorithmic trading as an ideal choice for establishing resilient, scalable, high-speed, and efficient trading enterprises.

For End Users:

Emotionless Trading: Trading bots have no emotions trading through profits and losses and can stick to trading strategies and plans no matter how volatile the market is.

Time Efficiency: Unless there is a software bug owing to a technical glitch, computer software never gets tired, makes mistakes, or gets distracted while executing a trade.

Customizability: Users can customize bots to apply different trading strategies with different goals and risk tolerance.

The Limitations of AI Trading Bots

While the advantages of building a trading bot are many, there are a few pitfalls, too, and you must consider them before diving into the world of trading bots and creating trading bots from scratch.

Let’s look at each of them below.

- Automating complex real-world trading operations into a software solution might be difficult; manual trading can fare much better in such situations.

- Algorithmic trading strategies, if not tested and optimized correctly, can be prone to software bugs, and there are chances of the automated operations being wiped out entirely.

- Trading bots require more time, effort, and research than manual trading.

- At times, trading bots may underperform in the face of unexpected financial crises, often referred to as 'black swan' events, such as the LTCM crash, Knight Capital crash, and the 2010 flash crash.

6. Future Trends of Trading Bots

Trading bots are getting more and more popular and important in the trading market, and the future of trading bots is likely to be shaped by trends as follows:

Integration with Large Data: Trading bots will more frequently employ large data analytics to analyze vast amounts of information, so as to improve accuracy and effectiveness.

Enhanced Security: There will be greater focus on security to protect against fraud and hacking.

Increased Use of AI: As AI has become the dorm recently, more trading bots will implement AI to enhance adaptability, so bots will become more sophisticated and execute more complex strategies.

7. Conclusion

Making your own trading bot has many advantages. Your trading activities become more efficient and reliable thanks to automation, which relieves you from the limitations of manual execution. You can maximize your earnings by adjusting your bot to changing market conditions and utilizing the power of machine learning and AI.

Start with the basics, continuously learn and adapt, and always appreciate the value of ongoing optimization. The dynamic world of trading awaits, and with your customized bot as your ally, the possibilities are limitless.

Leave a Reply.