Top 6 Finance Chatbots [2024 Updated]

With the advancement of artificial intelligence, the use of chatbots saw significant growth in 2022. Chatbots have gradually penetrated various industries and sectors, and the financial industry is no exception.

The financial services is one of the top 5 industries benefiting from AI chatbots. It is estimated that by 2030, the BFSI (Banking, Financial Services, and Insurance) chatbot market is expected to reach nearly $7 billion. More and more banks and financial companies are using chatbots to enhance customer service and improve operational efficiency.

If you're curious about how finance chatbots are making an impact, then please continue reading this article. Additionally, this article will provide the best finance chatbots platforms.

Part 1. What is A Finance Chatbot?

Finance chatbots are chatbots applied in the field of finance. Most of these chatbots are programs based on advanced artificial intelligence technology. They can mimic humans and engage in conversations with customers, helping customers solve various repetitive problems, such as bill inquiries, balance inquiries, and more. Some advanced finance chatbots can even provide users with financial analysis and investment advice.

Finance chatbots exist in various forms to meet different business needs and interaction modes. They are typically integrated into websites, applications, social media, voice assistants, self-service platforms (ATMs), and more.

They are available 24*7 and can be reached by customers anytime, anywhere. Able to continuously train and learn on their own with AI technology to improve response time and accuracy to customers.

More than 43% of US digital banking users responded that they are more than happy to use chatbot for their financial needs, as the use of finance chatbot has saved them from having to wait for lengthy manual reviews as in the past.

Part 2. Use Cases of Chatbots in Financial Services

There are thousands of use cases for Finance chatbot, 4 main use cases are summarized below.

1. Addressing common inquiries/repetitive tasks

Every day, countless customers may inquire about the same questions to banks or financial institutions, such as, "What is my balance?" "What are my expenditures expenses?" "How can new users complete the onboarding process?" and so on. Handling these large volumes of simple questions manually would incur huge costs, while AI-powered financial chatbots can swiftly address these routine inquiries. They are typically available 24/7, assisting users anytime, anywhere. Even when faced with complex tasks beyond their capabilities, they guide users to human representatives.

Bank of America has indicated that, as of September 2022, its AI chatbot Erica has engaged in over 170,000 conversations with customers, addressing numerous repetitive inquiries for Bank of America.. Erica engages in text or voice conversations with customers based on NLP (Natural Language Processing) and ML (Machine Learning) technologies. The answers it provides are acknowledged by over 98% of customers.

2. Loan and Mortgage Assistance

One of the most time- and effort-consuming tasks for banks and financial institutions is loan management. Typically, people visit bank branches or financial companies in person and wait in line to discuss their loan needs, payment plans, and eligibility. Another time-consuming aspect is the collection and verification of official documents required for these processes.

Finance chatbots can now perform all these tasks without the need for human agents. They can easily check a customer’s eligibility and provide information on eligibility criteria. Additionally, they can automatically calculate payment plans and reschedule them upon customer request. These bots can offer guidance and answer questions throughout the application process, as well as upload and verify the correctness of documents.

3. Preventing Fraud

Fraudulent acvities are common bleeding wound of digital services and there is no exception for finance services. In 2023, there are over 1,000 reported fraud attemps in a year 35% of companies and also an increase in fraud attemps for customer accounts reported by 61% of companies.

Fraud attacks can break customer confidence easily and cause financial and reputational damage to business easily. But now, finance chatbots can detect and hence, prevent fraud by analyzing previous customer habits and actions. These AI-chatbots offer real-time monitoring services and, upon identifying suspicious activity, can swiftly notify both financial institutions and customers—often faster than human customer representatives.

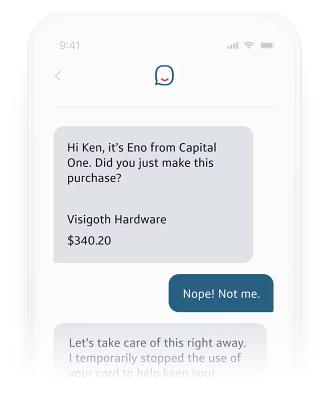

According to the United States bank holding company Capital One, its AI-powered financial chatbot, Eno, not only offers users basic account balance inquiries and transaction searches but also provides account monitoring and fraud prevention features to ensure the security of users' assets. Analyst Peter Wannemacher stated that Eno has successfully sent numerous effective fraud alerts for Capital One, making it the top fraud-preventing financial chatbot in the US banking industry.

4. Lead Generation and Cross-Selling

Most people are aware of the different services and products offered by financial service providers, but many customers lack detailed knowledge of each item to make informed choices. In the past, human sales representatives had to engage in lengthy conversations to understand the customer's financial situation and investment needs before recommending financial products.

However, digital applications and finance chatbots can offer various products or plans based on the user's current status or previous actions.

For example, if a customer asks a finance chatbot for exchange rate information, the bot can provide additional details about exchange interest rates and guide the customer to open a new account in a foreign currency. Similarly, a simple address change in a customer's profile can prompt a finance AI chatbot to recognize a new opportunity to sell renter's insurance.

Part 3. Top 6 Finance Chatbots

There are dozens maybe hundreds of chatbot for finance in the market, but some of them have been praised more than others and preferred by well-known companies in the finance world. Below, we have gathered latest information regarding top finance chatbots in the market with features and reviews.

1. Kasisto - Most Recommended

Kasisto is an artificial intelligence enterprise serving global financial institutions and regional banks. Its flagship product, the KAI platform, is a conversational AI platform based on deep learning and natural language processing. It is primarily used to provide personalized customer service and automate processes for banks and financial institutions. What sets it apart from other widely-used AI chatbot platforms is its deep understanding of the financial industry. Instead of broad content, the KAI platform utilizes a wealth of specialized financial knowledge. Currently, Kasisto has partnered with multiple financial institutions and banks, including NCR, Q2, and others.

Key Features

- Deep understanding of financial industry processes and customer needs.

- Customized recommendations, animations, and graphics.

- Compliance with financial industry regulations and security requirements.

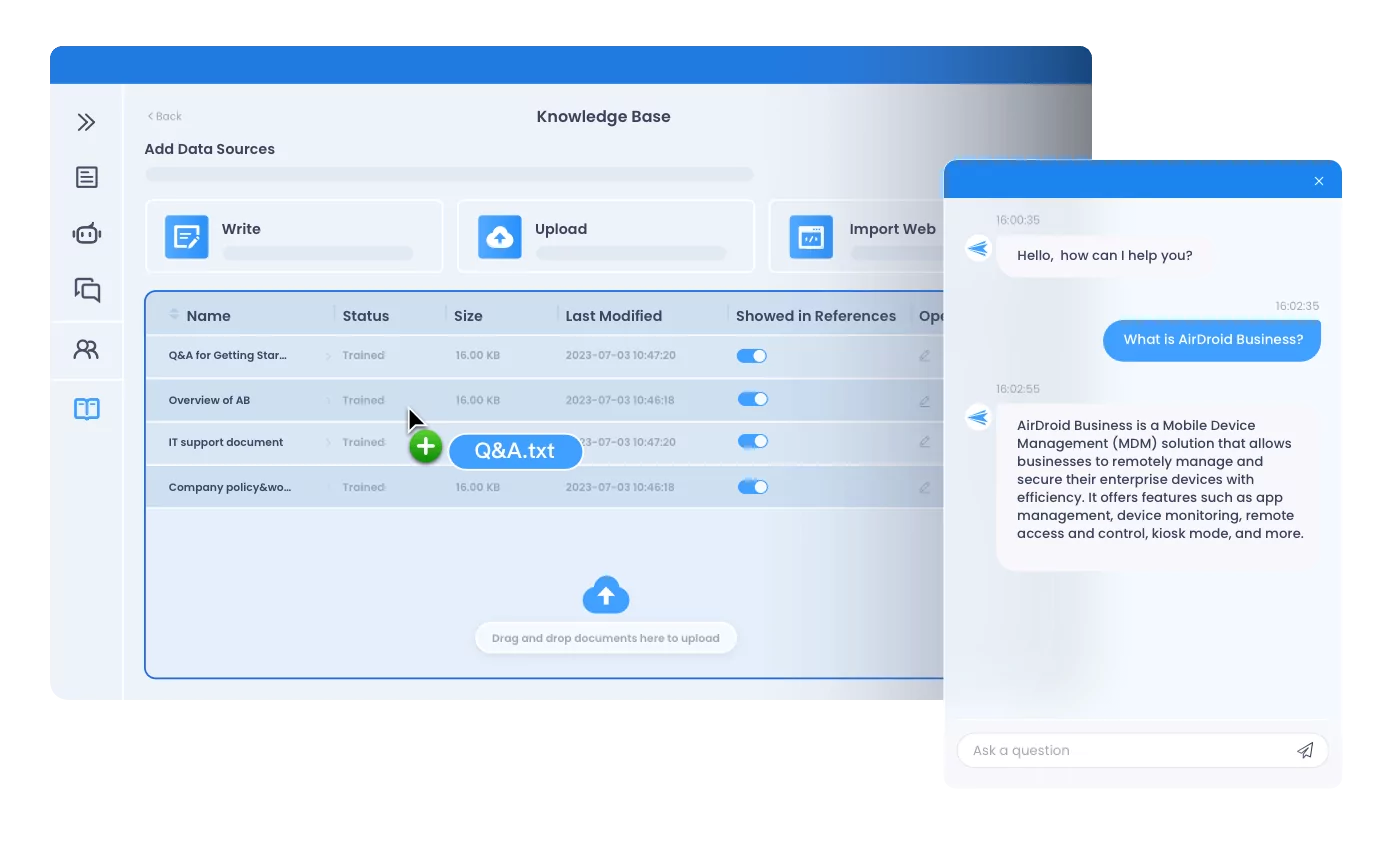

2. ChatInsight

ChatInsight is a platform that allows individuals or businesses to create their own AI chatbots that utilize a proprietary knowledge base to provide accurate and effective answers. If you need to use ChatInsight to create a financial chatbot, you only need to provide it with a knowledge base about the financial industry. It will use LLM (Large Language Model) to understand and reason through the content, providing accurate and effective responses to customer queries.

Key Features

- Understand complex semantics and generate natural language.

- Integrate with enterprise knowledge base to provide accurate responses.

- Support multi-language.

- Free Trial.

3. TARS

TARS is another popular option for chatbots in finance and yet it is designed to automate a wide array of financial tasks besides being a real-time customer support agent. This chatbot infrastructure comes with more than 1,000 different chatbot templates while 322 of them specifically designed for banking purposes. A business can use one of these templates as a widget in their website or app. This flexibility greatly distinguishes this software from others in the market.

Also, its ability to handle multiple requests across various channels simultaneously makes it a strong team mate of your real customer service. Users have praised TARS for usually its great performance while offering flexibility to finance companies and the time-saving benefits it provides.

Key Features

- Thousand of chatbot templates for different business niches with easy set up.

- Comes with geolocation feature to personalize customer experience.

- Simple answers for customer inquries.

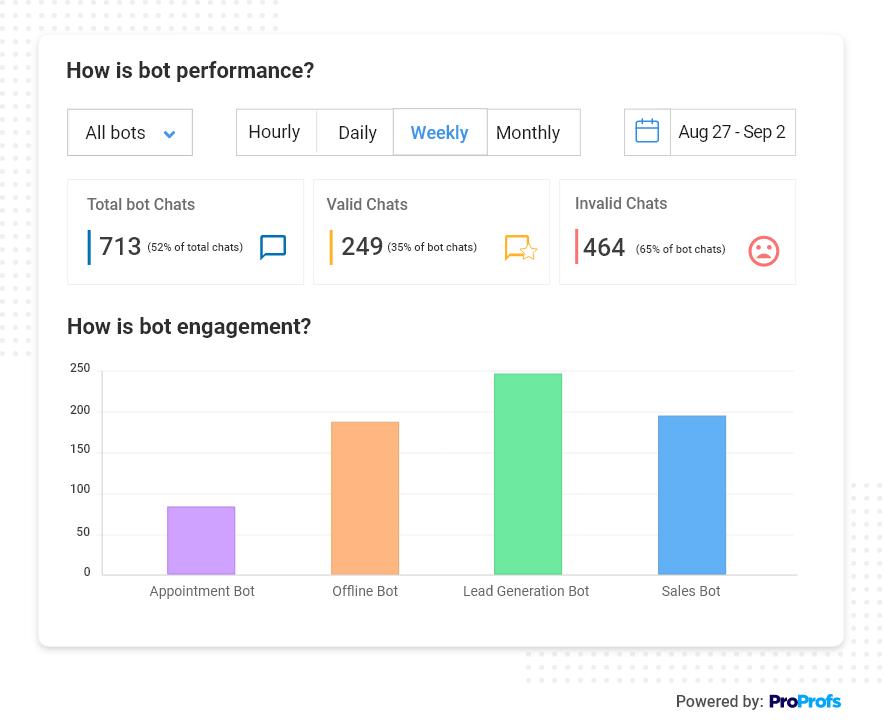

4. ProProfs Chat

ProProfs Chat is a live chat software solution and another one in finance advisor chatbot list that is gaining traction for real-time conversations between businesses and their visitors. Like others, it comes with alot of features designed to enhance customer support and engagement. Such as, the platform offers quick notifications of incoming customer queries and answers them in seconds.

One of the standout features of ProProfs Chat is its customization options among other chatbots in finance. The software includes visitor monitoring, third-party integrations, surveys after customer chats, offline requests for callbacks, file sharing, and performance reports for your real employees to look at.

The ease of use is frequently loved by users in reviews. Generally they say that the interface intuitive and straightforward. ProProfs Chat is also praised for its customer service since the platform offers 24/7 online support, ensuring that help is available whenever it's needed.

Key Features

- Offers ready-to-use templates for lead generation, automated customer greeting, ticketing, etc.

- Collects and saves chat transcripts so that you can review customer chats.

- Easy to set up and integrate with to CRM depository.

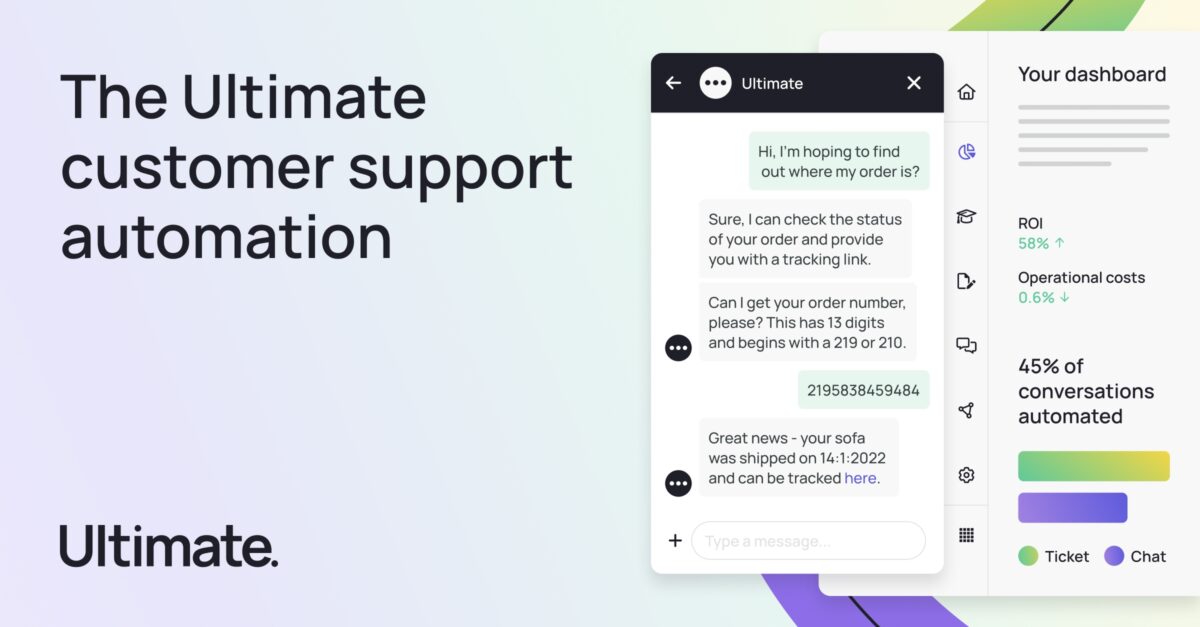

5. Ultimate.ai

Ultimate.ai is another customer support program but it aims to help all businesses from worldwide. With thee integration of advanced natural language processing (NLP) and machine learning algorithms has enabled this chatbot to understand and respond to human queries in fastest way possible.

It stands out with automating most customer interactions, such as answering FAQs, or booking appointments for client as well as verifying transactions, and working as financial advisor chatbot.

Among the plethora of AI chatbots, Ultimate AI, a platform praised for its ability to scale customer support with artificial intelligence. Because this customer support software stands out with its impressive 4.6-star rating on G2. Users mostly recommend its seamless integration and the significant impact on customer service efficiency.

Key Features

- Multi-language support to train the chatbot for international operations.

- Work with different CRM tools like Salesforce or Zendesk.

- Performing tasks like activating cards or accounts for clients replaces the need for human agents.

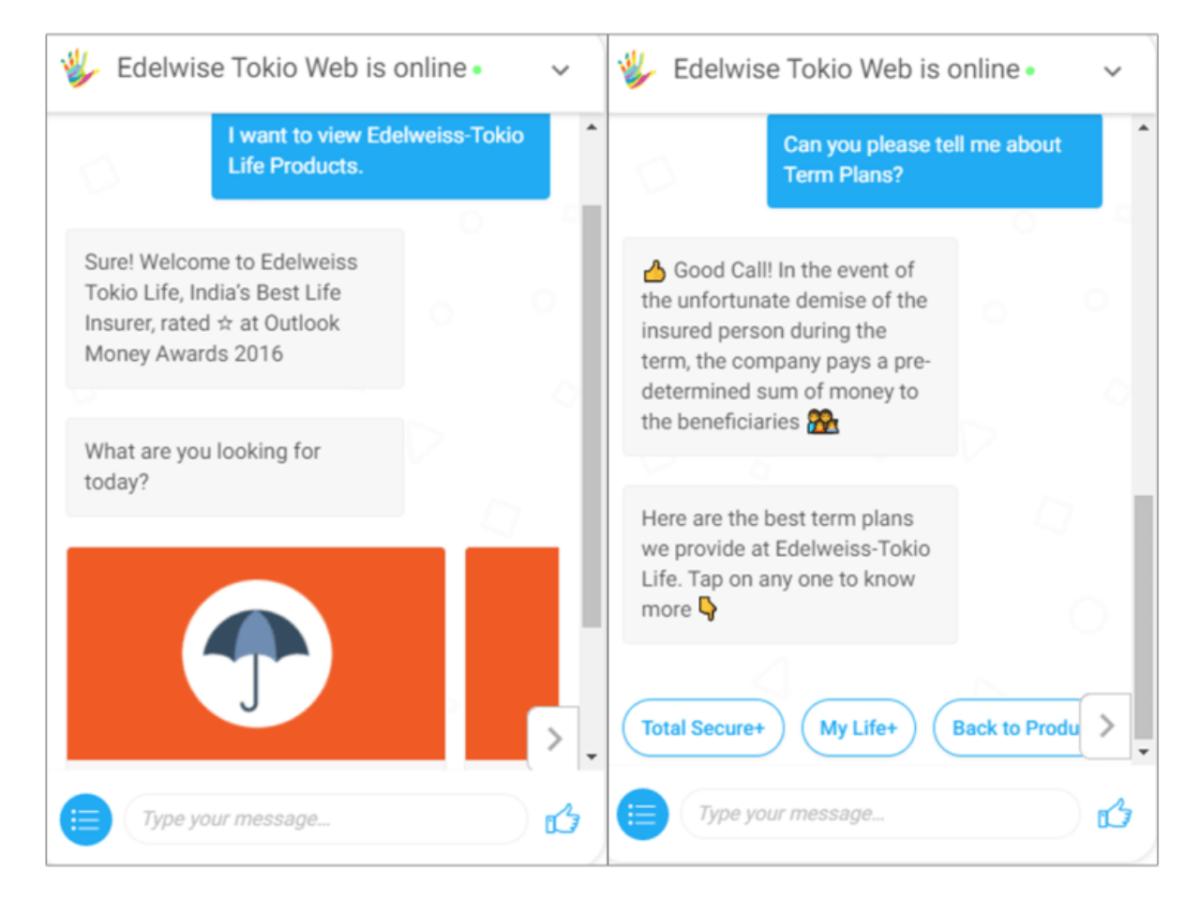

6. Haptik

Haptik chatbot for finance has also emerged as a significant player in this finance chatbot world. This conversational AI bot can streamline interactions between businesses and their customers among industries. And it is offering a blend of automation and personal touch for client relationship and daily tasks.

Haptik can serve to different industries, not only for banking-specific, hence, whether it's booking a service, or a widget that asks for recommendations from existing users, or customer support agent, Haptik can handle a wide range of customer interactions. Since it allows for quick set up and deployment, it is easy to integrate it with multiple channels such as different CRM. This easiness is making it accessible for businesses of different scales.

Key Features

- Work for different industries including finance.

- Easy to connect the IVA to other tools, such as CRM, ticketing systems, or ERP systems.

- Use open APIs which makes it flexible for adjustments.

- Send timely updates and reminders regarding your financial matters.

Conclusion

Chatbots in finance are becomeing invaluable assets in the financial industry and transforming relationships of customers with their finance service providers. These intelligent assistants provide faster and more efficient customer support than many on-site customer services.

Leave a Reply.