5 Top Insurance Chatbots 2024

The insurance landscape has changed rapidly over the last 5 years. Today, 69% of potential customers search online before scheduling a call. Handling such clientele requires 24/7 monitoring of your online chats, even after office hours!

While this might seem impractical, an insurance chatbot can make the difference. With the ideal response time set at 5 minutes, it even makes more sense to employ this technology. That said, we're going to explore how insurance chatbots can make things easier for people. Let's get started.

Part 1. What Is an Insurance Chatbot?

An insurance chatbot is a tool that helps handle clients' queries, onboarding new customers, and other tasks through automation. Think of it like a virtual assistant on duty 24/7, providing instant support and enhancing customer experience while streamlining operational processes for the insurance company.

The chatbots can handle tasks like:

- Customer support

- Policy management

- Claims processing

- Lead generation and sales

- Appointment scheduling

Insurance chatbots use generative AI, machine learning, deep learning, natural language processing, and pre-scripted responses to answer questions or perform tasks. According to Statista, over 43% of Americans are willing to use chatbots to apply for insurance or make claims. This shows that technology is widely accepted in the industry.

Part 2. Use Cases of Insurance Chatbot

The possibilities of chatbots for insurance agents are limitless. If you are wondering how to deploy the tools in your business, here are some of the use cases.

Automation of Claims

A survey by Voxco shows that over 30% of customers change insurers after a poor claim experience. Chatbots can increase claim submission, assessment, and processing efficiency by guiding clients through each step.

Insurance bots allow customers to submit details about incidents, dates, locations, and relevant documents. Through the information, the chatbots can identify inconsistencies and flag fraudulent claims.

Client Onboarding

First impressions can make or break a deal. So, reducing friction in the sign-up process can be a game-changer in closing more insurance deals. A chatbot for insurance companies allows you to share "how-to" guidelines and other essential information with potential customers. Because chatbots allow synchronization of different channels, it is possible to continue conversations across various platforms.

FAQs Automation

Unlike employees, chatbots are available 24/7, allowing you to handle frequently asked questions outside regular working hours. After setting up a database with relevant information, the tools can assess queries and give accurate responses, saving your team valuable time to focus on complex aspects of the business. If the requests are beyond the chatbot training, it connects the user to a human support agent.

Cross Selling

More than 39% of insured individuals hold more than one policy from a single provider. This shows you can up-sell and cross-sell to existing or new clients to increase business profitability. Insurance chatbots use data stored in their database to assess preferred policies and recommend tailored solutions to different customers. This approach increases your chances of conversion.

Part 3. Benefits of Insurance Chatbots

The application of chatbots has immense benefits to the business and customers being served. However, you need to align the tool to your business goals to maximize the impact. Insurance bots can lead to:

Increased Customer Service Efficiency

Customer service efficiency or inefficiency affects conversion, referral, and customer retention rates. A report by Hubspot showed that 93% of customers are likely to buy again from businesses with good customer service. And who would like to miss out on such an opportunity?

Insurance chatbots increase efficiency by:

- Reducing response time

- Automating repetitive queries

- Supporting multi-lingual clientele

Reduction in Costs

First, freeing up repetitive tasks from your team increases the time spent on resolving complex tasks, maximizing their output. Apart from that, chatbots can handle large volumes of tasks simultaneously. Chatbots Magazine stipulates that bots can reduce your customer service costs by up to 30%.

Improved Fraud Detection

A study by the Coalition Against Insurance Fraud (CAIF) indicated that insurance fraud costs the US over $308 billion annually. This translates to $400-$700 extra premiums per family annually. Machine learning is one of the technologies used to identify patterns in fraudulent insurance claims.

Service Personalization

As earlier noted, artificial intelligence helps in service recommendation by analyzing customer data and preferences, enabling insurers to offer tailored policy options. The technology also tailors communication to meet individual needs, increasing customer satisfaction and loyalty.

Part 4. 3 Best Examples of Insurance Chatbots

Start-ups and established companies have embraced chatbot technology to enhance customer service, streamline operations, and provide more personalized experiences. Here are 3 use cases and the success stories.

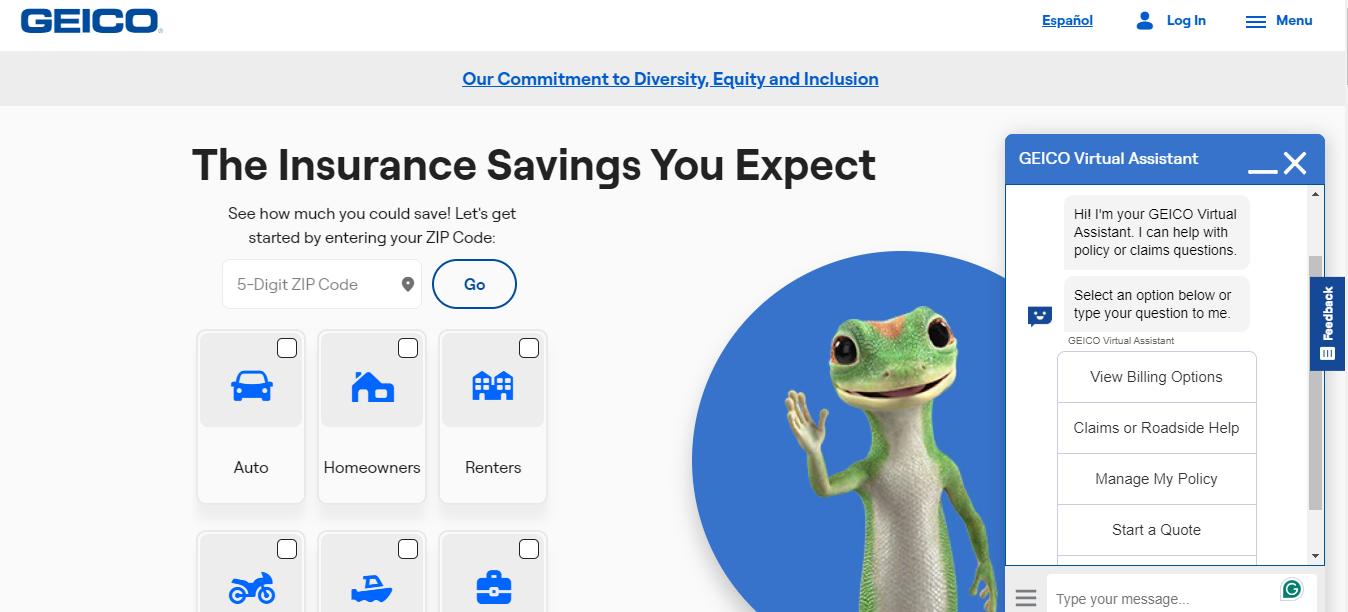

1. GEICO Virtual Assistant

GEICO was one of the frontrunners in implementing this technology in the insurance industry. The company introduced "Kate" a virtual assistant in 2017 with capabilities to handle repetitive queries like customer balances on auto insurance policies.

With advancements in artificial intelligence over the years, the GEICO chatbot has only improved. Today, the tool can handle more complex queries like voice prompts, billing inquiries, policy changes, and lodging claims.

The ease of integration with the company's mobile app (for Android and iOS users) has ensured access for most customers. Consequently, the accessibility has reduced the customer queries directly handled by human customer support agents significantly.

The ability of Kate to induce humor in conversation makes it fun to interact with the tool. As Pete Meoli, Geico mobile and digital experience director, put it, "Kate is very intuitive and has been programmed to connect with policyholders at a deeper level."

The advanced technology used in GEICO's chatbot has made it a pacesetter in the insurance industry.

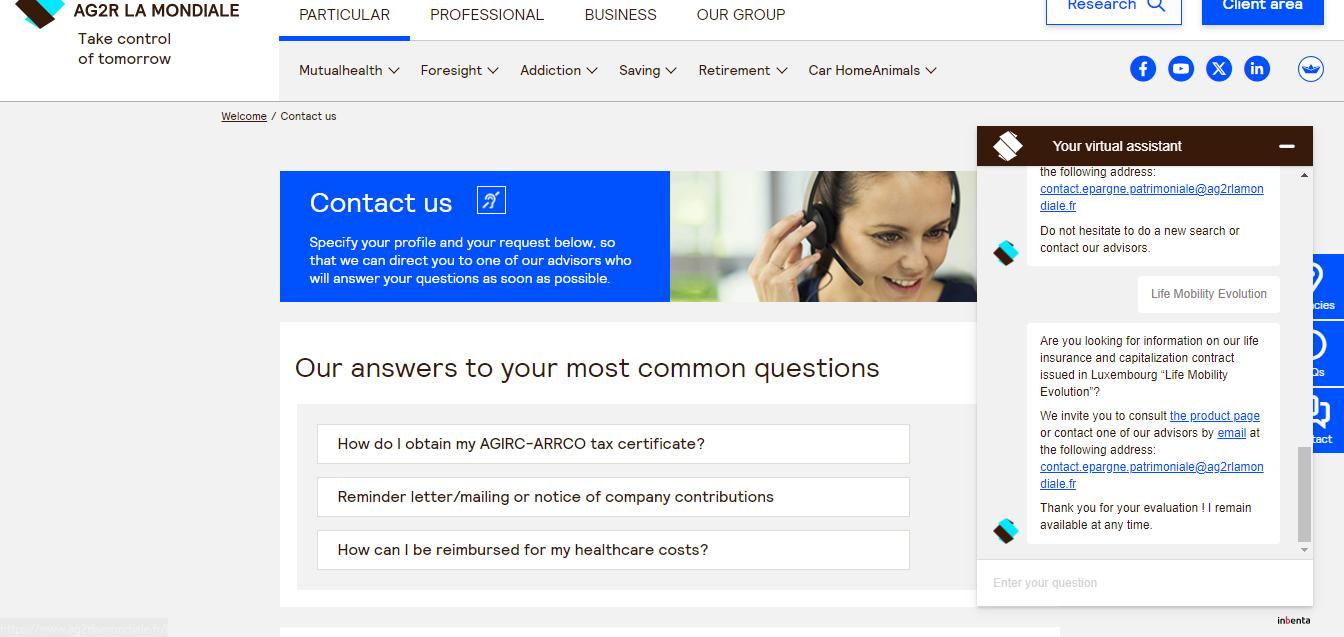

2. AG2R La Mondiale

Because conversational AI for insurance can understand different languages, it is possible to interact with this tool from other countries rather than France. This chatbot helps AG2R La Mondiale respond to repetitive queries without human customer support agents, recommend the right insurance policy, and share information about different policies.

The tool was created using Inbenta, a chatbot builder that offers customer service, IT helpdesk, marketing and sales, and digital transformation solutions. Through the virtual assistant, the company has recorded the following:

- Around 550 sessions daily, which translates to 165,000 per month

- 5%-10% engagements from the company's service areas

- More than 66% of the engagement from the contact page

The company has also gained insightful information about customers' and prospects' issues, allowing faster resolutions. The tool can also track query frequency, which helps analyze customer query trends. This allows AG2R La Mondiale to create tailored solutions.

According to the company, the chatbot has increased customer satisfaction by 30%.

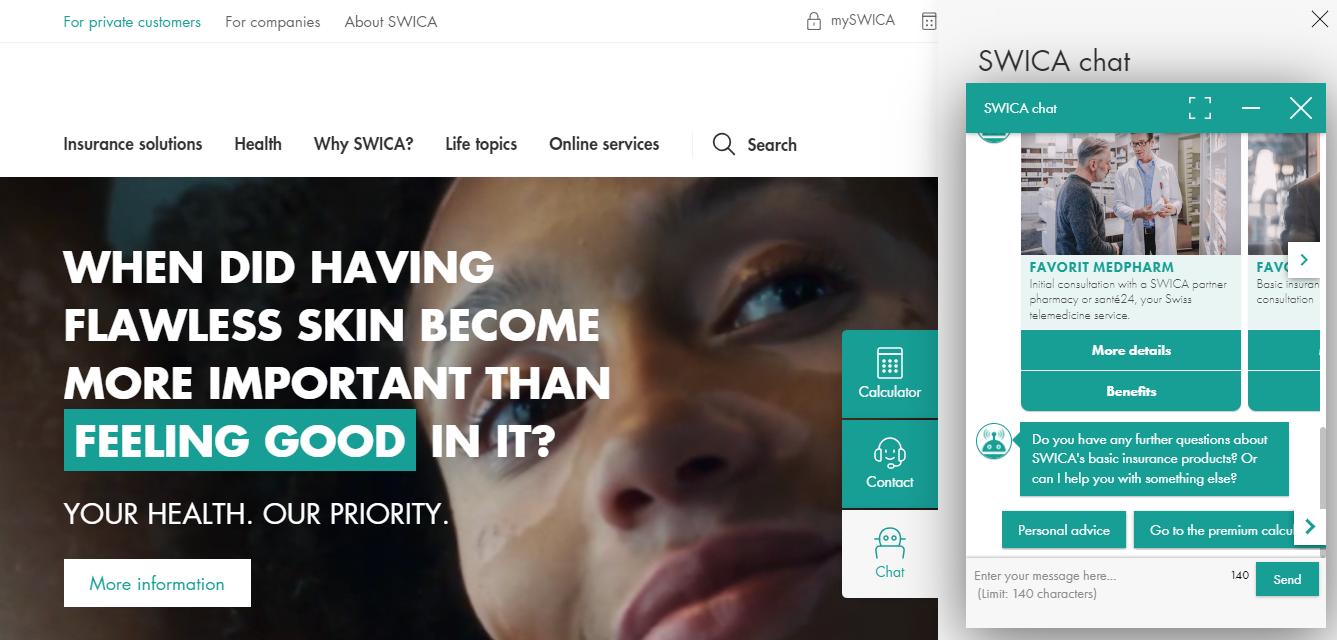

3. SWICA Chat

The healthcare insurance sector is one of the most competitive in the industry. Every lost conversion or lead means a lost opportunity that could affect business margins negatively. Maintaining a balance between ethical practice and marketing is a challenge, considering the sensitivity of the issue.

SWICA has mastered the art of instant customer engagement to ensure maximum satisfaction. The company's intuitive chatbot allows seamless address updates, query responses, franchise switches, and ID card requests.

Through SWICA Chat, you can add family members to the policy or increase accident coverage. The customer support chatbot has set SWICA apart, ensuring they respond to clients 24/7. You can also switch between languages, making the tool ideal for a multi-lingual clientele.

Thanks to the advanced training of conversational AI for insurance, it can handle complex tasks like insurance recommendations and onboarding. This not only frees time for the customer support team but also ensures there are no gaps in the customer journey.

Part 5. 5 Best Insurance Chatbots 2024

Finding the right chatbot for your insurance company depends on the goal you want to achieve. Although most promise to deliver in all aspects, it is possible to see their strengths. Let's guide you through some of the top insurance bots to help you make an informed choice.

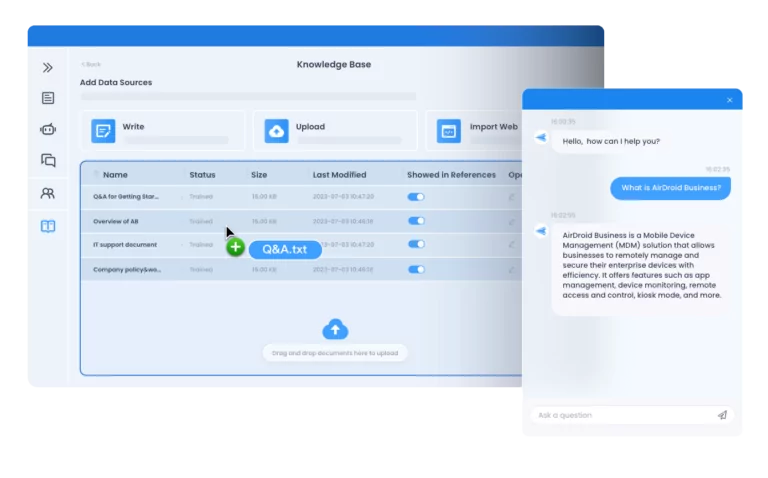

1. ChatInsight

This platform uses generative AI, machine learning, and natural language processing to support repetitive tasks repetitive tasks. You can rely on ChatInsight to:

- Respond to frequently asked questions

- Guide prospects through the onboarding process

- Share essential documents and links to helpful information

- Support employees instead of relying on IT or customer support in everything

Besides artificial intelligence, ChatInsight can access your knowledge database and retrieve relevant information depending on customer queries. The platform has a straightforward interface that requires no technical skills to create and manage a chatbot.

Key Features

- Customer Support Chatbot: Allows you to create a conversation insurance AI chatbot to respond to clients' queries instantly

- Employee Support: You can create a centralized knowledge base for employees to access essential information or files

- Marketing Support: Whether you want to qualify leads or track customers through the purchase journey, ChatInsight is a handy tool

- AI Business Card: Boost your credulity with a detailed AI business card that contains contact information, service details, and schedule

Pros

- Easy to create an insurance chatbot

- Supports diverse business functions

- Helps in the centralization of operations

Cons

- Challenging to process complex requests

- Requires some integrations to increase its functionality

Pricing

ChatInsight has a generous free trial that includes 5 chatbots. The paid packages start at the Basic Plan at $16.58 per month, billed annually. Other packages include Standard ($24.92) and Enterprise ($41.58). You can also opt for monthly packages, although the rates are higher.

2. Inbenta

Automating customer support, billing, and other repetitive tasks can be a relive to your customer support team. Inbenta uses artificial intelligence to streamline customer support, marketing, HR, and helpdesk operations, allowing your team to focus on more complex and value-added tasks.

Insurance companies like DKV, AG2R La Mondiale, Generali, and GIO use the tool. If the tool can't handle your request, it transfers the chat to a human agent. Through Inbenta, you ensure no communication or contact gap with the client, especially at the initial stage.

Key Features

- Virtual Assistant: The tool allows you to share general and tailored information with your clients and prospects

- Onboarding Assistant: Potential customers can get details about your business like bank accounts, necessary documentation, and contact information

- Tailored Insurance Recommendation: Through preference assessment, Inbenta can offer customized solutions

Pros

- Advanced capability to handle complex tasks

- Easy to use and a simple interface

- Tailored solutions to meet clients' needs

Cons

- Considerably expensive

- Doesn't have a free trial

Pricing

The vendor doesn't indicate the price on the website. However, some reviews show prices start from $4000 annually.

3. SendPulse

This AI-powered chatbot helps you respond to customers' queries instantly. The tool can handle insurance processing, marketing and sales, policy management, and customer support operations.

You can use SendPulse to centralize communication across social media platforms and your website. This strategy makes it easy to track customer engagement and ensure consistent messaging, improving overall customer experience and satisfaction.

Key Features

- Live Chat: You can automate customer engagement across Facebook, WhatsApp, Telegram, and other social media platforms

- Workflow Management: Has comprehensive functionality to manage most aspects of your business

Pros

- Comprehensive insurance business management tool

- Easy to centralize business communication

- Has a generous free trial

Cons

- Expensive for businesses with a significant subscriber list

- The chat page is unattractive

Pricing

SendPlus has a free trial that accommodates up to 3 chatbots. The paid version starts at $8 per month (billed annually) for 500 subscribers and increases gradually, depending on your contact list size.

4. Heretto Chatbot

This self-service platform allows customers, employees, and prospects to access information when and where they need it. The company uses sophisticated algorithms and artificial intelligence to structure your knowledge base simply and comprehensively.

Heretto was created based on Harvard Research, which shows that 81% of customers try self-service before contacting your business. AllState chatbot is one of the knowledge bases built from Heretto technology. From experience, the insurance chatbot does a good job of answering most customer queries instantly.

Key Features

- Centralized Knowledge Base: Ability to harmonize all data points and give accurate answers

- Service Personalization: Seeks to understand customers to give tailored services and recommendations

- Content Creation: Uses artificial intelligence to help in content creation

Pros

- Uses diverse data points to handle complex queries

- A user-friendly and intuitive interface

- Centralized knowledge base

Cons

- Rigid features

- Doesn't display pricing on the website

Pricing

Contact the seller to get a tailored package.

5. Born Digital AI

Thanks to the success of the AXA chatbot, Born Digital makes it to our list. The company offers tailored solutions across different industries. You can use the tool to create an insurance chatbot that handles repetitive and complex operations.

Some of the operations that the bot can handle include roadside emergencies, booking rescue cabs, and answering spontaneous questions. Born Digital uses advanced natural language processing and machine learning to create intuitive chatbots.

Key Features

- Advanced chatbot: Understands text and voice queries. Apart from that, the tool can handle different languages.

- Customer Analytics: Provides data on customer engagement to help you identify business trends

- Email Automation: You can set rules and conditions to trigger email conversions with prospects and customers

Pros

- Can handle complex insurance operations

- Gives more accurate information because of diverse data sources

- Provides omnichannel solutions

Cons

- No display of pricing on the website

- Limitations in integrations with some non-cloud platforms

Pricing

Born Digital offers tailored solutions depending on your needs.

Conclusion

From processing claims, answering customer queries, detecting fraudulent patents, and managing knowledge base, insurance chatbots can handle most operations. This blog post has taken you through the ins and outs of this technology to help you choose the most ideal. Remember, your insurance business goals determine your choice.

Leave a Reply.