Apple Pay Scams: How to Spot, Avoid, and Get Your Money Back

Digital wallets and online payments are extremely convenient, but they’re on the radar of scammers trying to steal your hard-earned money.

In 2023 alone, almost 5,000 scammers impersonated Apple resulting in total losses of $17 million. What’s even worse is that it’s tricky to get your money back, if at all.

To protect you from such scams and fraudsters, we’ve created this guide explaining how to get Apple Pay scam refunds for different payment methods. We’ll also share some common scam tactics you need to be aware of and tips to use Apple Pay safely.

What Are Apple Pay Scams and How Do They Work?

Apple Pay is a digital wallet and payment technology designed exclusively for Apple devices. Since it’s a widely-used platform to make payments to businesses or retailers, it’s a common target for scammers.

Apple Pay scams are fraudulent activities where scammers exploit the platform to steal your money or personal information. They typically deceive users into sharing sensitive details or trick them into making fraudulent transactions.

The scammers’ goal? To get you to share your Apple ID or banking details so they can access your Apple Wallet and any cards you’ve linked to it.

While Apple Pay incorporates robust security features, criminals have found creative ways to bypass these protections by targeting the human element of the transaction process.

How Can You Get Scammed on Apple Pay?

It’s important to note that most Apple Pay scams don’t happen because of technical vulnerabilities, but by exploiting user trust.

Scammers use various social engineering tricks to target Apple Pay users—manipulating users into sharing sensitive information by creating a sense of urgency or confusion.

For example, here are some common scam tactics:

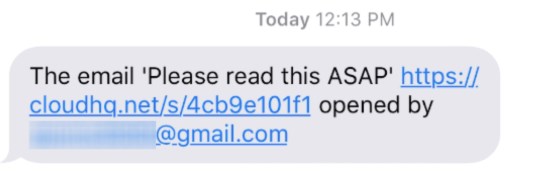

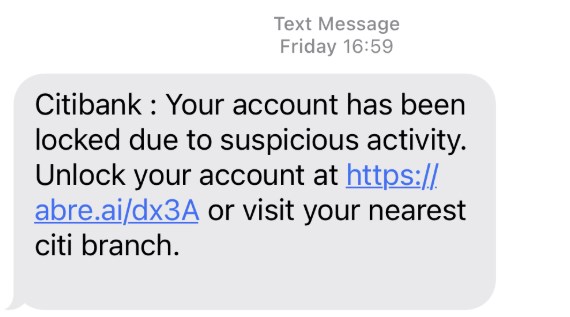

- Phishing email—You might receive an email claiming to be from Apple claiming your account is suspended, requiring immediate action

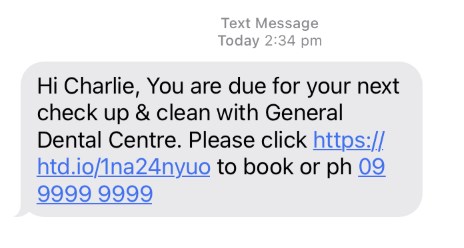

- Fake texts or calls—You could get a text or call pretending to be customer support or a family member, requesting your account information

- Counterfeit websites—Some even create counterfeit websites that mimic Apple’s to steal your credentials

The scam could then ask you to click a link and enter sensitive information. If you do that, you open the door to fraudulent transactions.

There are many more types of Apple Pay scams apart from these. However, one thing that’s common is these scams are designed to feel urgent and real, making it easy to fall for them if you’re not careful.

How to Get Money Back from Apple Pay If Scammed?

If you've been scammed while using Apple Pay, the process for getting your money back will depend on how the payment was made—such as Apple Cash, credit card, or debit card. Below are steps and recommendations for each scenario.

1If You Used a Credit Card

Credit cards are relatively easier to get your money back compared to debit cards or wallet transactions—thanks to easy dispute and chargeback mechanisms.

If you’ve been scammed using a credit card linked to Apple Pay, contact your credit card issuer immediately. For example, if you’ve noticed a charge for an item you didn’t buy, let them know about the transaction.

They’ll guide you through their specific dispute process, which might include providing transaction details or any evidence that supports your claim—including screenshots, communication records, and transaction details.

The dispute process can take 75-120 days to resolve. Your bank will typically issue a temporary credit while they investigate.

Note: Apple doesn’t directly handle disputes for credit card transactions, it’s your card issuer’s responsibility. So make sure you follow their instructions closely to resolve the issue quickly.

2If You Used Apple Cash

Apple Cash functions like physical cash, meaning there's no purchase protection or dispute process for payments made through it. If you've sent money to a scammer via Apple Cash, reversing the transaction is, unfortunately, not an option.

In that case, you have two options:

- Contact Apple Support—While Apple can't reverse Apple Cash payments, they can help secure your account and prevent further illegal transactions

- File a police report—If the amount lost is substantial or involves criminal fraud, your best recourse if to report Apple Pay fraud with your local police or the FTC through their ReportFraud page.

3If You Used a Debit Card

Unlike credit cards, debit cards pull money directly from your bank account, leaving you without funds while the dispute is investigated. Not only that, it’s harder to recover money if scammed, and the dispute process takes much longer.

Contact your bank's fraud department immediately to report the unauthorized transaction. Every bank has a different process for handling these disputes, which might include filing a claim and providing any evidence you have.

The investigation process can take several weeks, and your bank isn't required to provide temporary credit during this time. But remember, banks typically don’t offer much fraud protection for debit cards compared to credit cards.

That's why financial experts recommend using credit cards instead of debit cards for digital payments—they prevent scammers from getting a hold of your bank account directly.

4Disputes with Merchants

If the payment was indeed authorized by you, but you’re facing an issue with a product or service (e.g., you didn’t receive the goods or received fake products), you’ll need to handle it directly with the merchant.

Remember, Apple doesn’t get involved in disputes between customers and merchants. You need to contact the merchant, explain the situation, and request a resolution.

If it’s a legitimate business, they’ll want to maintain their reputation and will work to resolve customer complaints. Many merchants have specific policies for refunds or chargebacks, so it’s important to follow their process.

However, if the merchant is unresponsive even after a few weeks, or refuses to help, then proceed with your bank dispute. Remember that most merchants prefer direct resolution over chargebacks because the latter is a complex and expensive process.

Key Takeaways:

In a nutshell, remember that Apple’s role is limited when dealing with Apple Pay fraud. While they are responsible for maintaining the security of Apple Pay itself, they don't process payments or handle transaction disputes directly.

Your best course of action depends on the payment method used, and here’s a quick summary:

| Payment Method | Protection Offered | What to Do | Recovery Possibility |

|---|---|---|---|

| Credit Cards | High | Dispute the charge with your card issuer | High |

| Apple Cash | None | Contact Apple Support or file a police report for significant losses | Very Low |

| Debit Cards | Limited | Contact your bank immediately to dispute the charge | Moderate |

How to Spot Common Apple Pay Scams?

Apple Pay is generally secure if you’re careful who you’re sending the money to. But below are a few tactics scammers use to trick you that you should watch out for.

1Phishing Scams

This is when scammers send fake emails or texts pretending to be from Apple, asking for your personal details or payment information. They’ll often say things like your Apple ID is restricted or suspended and you need to act fast to prevent lockout.

One common example is a message asking you to click a link to "verify" your account. The link will direct you to counterfeit websites to steal Apple ID credentials and payment information.

2Impersonation Scams

Here, scammers pretend to be someone you know like a friend or family member. Some even use AI voice cloning to make calls more convincing. They often claim they’re in an emergency or financial trouble and need your help urgently, asking for money through Apple Pay. If you get a call like this, hang up and call the person directly on their number or a relative to confirm.

3Overpayment Scams

In this scam, someone will “accidentally” send you excess money, then claim it was a mistake and ask you to refund the difference. The original payment is often made with a stolen card, so when the charge is reversed, you’re left out of pocket.

For example, one Reddit user reported receiving $287 from a random number, followed by threats demanding repayment. Be careful about returning money, especially if the situation seems off.

4Fake Apple Pay Payment Requests

You might get an unexpected request for money from someone you don’t know. They might say they’re buying something from you or paying for a service, but it’s a trap.

For example, a scammer might pose as a seller, asking you to pay upfront for an item but never deliver the promised goods. Always be suspicious of unexpected requests and confirm who they’re from.

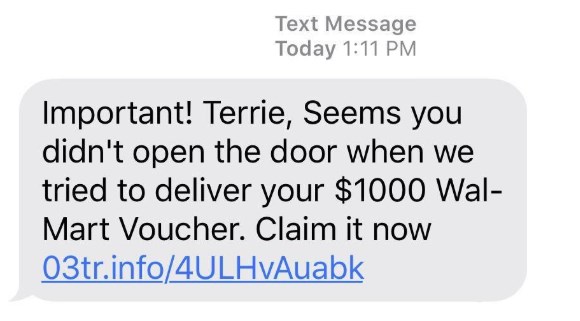

5Too-Good-To-Be-True Deals

You’ve probably seen those "unbelievable" deals that seem too good to pass up. Scammers love to use these offers to lure you in, especially during high-demand periods.

They might advertise items like concert tickets, gaming consoles, or luxury goods at ridiculously low prices and ask you to pay via Apple Pay. Once you send the money, the seller disappears and the item never arrives.

Always be cautious when you see an offer that sounds too good to be true. Do some research on the seller and double-check if they’re legitimate before making any payments.

6Third-Party App Scams Involving Apple Pay

Some third-party apps mimic legitimate Apple-affiliated services. They’ll pretend to offer free trials, discounts, or free Apple Cash while asking for your Apple Pay details.

These apps request sensitive information like Social Security numbers and Apple ID credentials under the guise of verification. They’ll use deceptive language to trick users into paying for features or services that don’t exist or are not as advertised.

For example, an app might offer a “free” trial but will immediately charge your Apple Pay account after you sign up. If you encounter a scammy app, you can report it directly to Apple as follows:

- 1. Locate the app in the App Store

- 2. Scroll to the information section and click "Report a problem"

- 3. Select "Report a scam or fraud"

- 4. Provide detailed description of the issue

7Scams Targeting Older Adults

The "Grandparent Scam" is particularly devastating, where scammers impersonate grandchildren in trouble and ask for immediate financial assistance through Apple Pay. Some scammers may even pretend to be from a government agency. They create emotional urgency, often claiming to need bail money or emergency medical payments.

It’s unfortunate that seniors lost an average of $431 to phone scams in 2022, with government imposter scams alone costing approximately $122 million in 2021.

Older adults should be extra cautious when they get unexpected calls or messages. Always verify the identity of the caller, especially if they’re asking for money. If something feels off, either hang up or check with a family member before taking any action.

How to Protect Yourself from Apple Pay Scams

Like with any well-known platform, scammers are always looking for new ways to exploit Apple Pay users.

The good news? With a few simple steps, you can significantly reduce your risk of falling victim to these scams. Here are a few tips to prevent Apple Pay scam:

Tip: Apple advises using Apple Cash primarily for sending money to friends and family. It’s not designed for paying for goods or services from unknown sellers or for online purchases. Stick to using it within your trusted circle to minimize risks.

Conclusion

While Apple Pay itself is secure, scammers often exploit loopholes in Apple Pay security, so you must be vigilant.

Treat your Apple Pay transactions with the same caution you'd use for physical payments. Try to use credit cards instead of debit cards as much as possible, and never share verification codes with anyone.

And remember the golden rule: if something seems too good to be true or creates unnecessary urgency, it's likely a scam.

Leave a Reply.