- Disable unnecessary device functions to control data expenses.

- Monitor data usage of multiple devices on a single dashboard.

- Restrict corporate devices to run only approved apps.

- Block social media apps to prevent work distractions.

Mobile Expense Management Process for Cost Savings

Companies are incurring more business-related expenses, with more employees working remotely than ever.

These costs must be managed through a mobile expense management program. Otherwise, organizations will accrue expenses from erroneous, non-work, or even fraudulent charges.

To build a strong mobile expense management program, organizations need tools that enable them to track spending, implement guardrails and policies, and monitor employees through reporting and auditing.

1Why Mobile Expense Management Matters?

Organizations often overlook mobile expense management in favor of other areas of the business they feel are more urgent. This approach is unfortunate, as employees who work remotely or in the field rack up significant expenses.

Company drivers will need to pay for gas and toll fees, account managers will need to cover the cost of client entertainment, and engineers deployed on-site to remote locations will need to buy their own meals.

When businesses neglect mobile expense management, they will experience several problems.

1.1A poor employee experience

Every professional has been in this situation before. You're out on official company business and expected to pay for a business-related expense. While this action may seem sensible, the challenges come in the aftermath.

Companies may not have clear reimbursement processes. When an employee submits the receipt to the accounting department, there may be little clarity on when he will be paid back for the mobile expense. This level of bureaucracy will sour the experience of employees, who may feel they are personally financing business expenses.

![]()

(Image credit: Pexels)

1.2Opportunity costs of poor mobile expense management

When a company has employees out in the field, they should attend to their core purpose. Salespeople should woo potential clients, service engineers should fix errant or offline hardware, and delivery drivers should get goods or people from point A to point B.

Companies with insufficient expense management processes undermine this focus. Instead of managing their core tasks, employees will take photos of receipts, fill out paperwork, and deal with accounting. These tasks represent a significant opportunity cost that diverts employee attention away from their main duties.

1.3Bad actors

Rogue employees may take advantage of companies with weak mobile expense management programs. They may submit personal expenses as official business expenses, submit the same receipt multiple times, or fabricate documents, which is easier in the age of generative artificial intelligence (AI).

These problems will cost the company in the short and long term. One, they may inadvertently pay for illegitimate mobile expenses. Two, the time spent investigating these cases and punishing perpetrators will be significantly more cost-intensive than installing proper guardrails in the first place.

2Implement MEM Process for Cost Savings

2.1Tracking mobile expenses

A robust program for mobile expense management begins with solid tracking. Companies and their employees do not usually have this ability. While employees may produce expenses daily, their tracking is far more irregular.

Employees may only sit down to focus on mobile expense management once they have free time; at this point, they may have lost receipts or forgotten about certain costs.

Employees need the ability to track their mobile expenses properly.

Real-time tracking of expenses

Most employees do not carry an accounting ledger. Nearly all employees, however, carry a smartphone at all times. Because employees have smartphones when working on the go, the best way to manage mobile expenses is through an app.

Some of these apps still require manual expense entry, which defeats the purpose of having one. Companies should instead look for an app that allows receipt capture by taking a photo. Using optical character recognition (OCR) technology, the app will ingest the photo and extract the relevant data, such as the vendor name, address, and purchase amount.

Users can classify each expense into the appropriate budget category. For example, a delivery driver may categorize a gas receipt into their monthly allowance for transportation through a tool like Expensify or Shoeboxed.

Real-time tracking of mobile expenditures

Organizations should not treat a mobile expense management app as the be-all and end-all of their expense management process. Outside of purchases at brick-and-mortar locations, mobile devices are the most significant employee expenses.

Employees may purchase unauthorized apps, incur fees for excessive data use, or get roaming charges for using the device outside the coverage area. Left untracked, these costs can quickly add up, affecting the cost efficiency of mobile workforces.

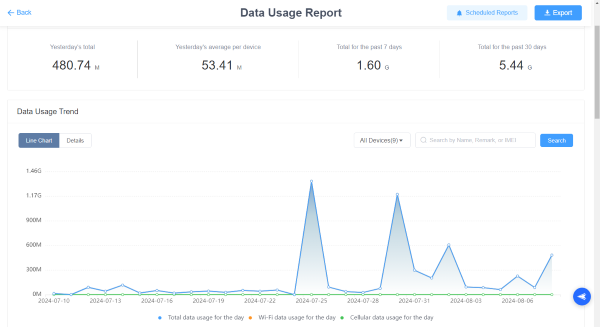

Companies should use an MDM like AirDroid Business. With an MDM, organizations can implement a device policy that prevents employees from purchasing or downloading unauthorized apps. More importantly, organizations can track data usage across the entire device or even on a per-app basis. To simplify this monitoring, businesses can set alerts for when employees cross a certain threshold of data use.

With these features, companies can ensure that mobile phone add-on costs remain consistent with what is necessary for business use.

2.2Implementing guardrails for mobile expenses

Some mobile expense management apps allow employees to file any expense as a business expense. This approach is problematic. If employees can submit any expense, a few bad actors will use this leeway to their advantage.

One person could file their dinner outside of work hours as a business expense, while another could claim that a personal trip out of town was also for business. While these edge cases will be identified, using man-hours to review and reject non-work expenses wastes time.

Mobile expense management apps must give organizations the ability to configure top-down guardrails into the implementation to minimize time spent on manual review and maximize cost savings.

(Image credit: Pexels)

Enforce policies around mobile expense management

The most cost-efficient apps in mobile expense management like Expensify allow businesses to set parameters on what employees can—and cannot—submit as expenses through customizable parameters and workflows.

For example, employees can prevent themselves from filing expenses that exceed that maximum reimbursable amount.

They can also block receipts from vendors outside the business vicinity or outside of standard working hours.

These policies must be carefully reviewed and implemented to ensure that legitimate expenses are not blocked. Upon deployment, these guardrails can produce significant cost savings for the business.

2.3Enforce Policies

Organizations should have a more granular view of device usage than only total bandwidth consumed. This view may not give you the full story.

Two employees may both exceed their bandwidth provision, but one may be from work-related sales calls and the other from streaming Netflix.

To understand these distinctions, organizations must have the ability to monitor network usage on a per application basis. With this ability, they can view the total list of apps on a person’s device and the data consumption per app. The organization can thus determine whether a person’s network usage is legitimate or for non-work purposes.

The best MDMs come equipped with this feature, empowering organizations to implement guardrails around fair usage of their devices. This feature ensures that employees do not exceed allocated bandwidth and drive up mobile expenses for non-work purposes.

Moreover, to prevent network abuse, companies should disable network sharing. AirDroid Business come equipped with this feature, empowering organizations to disable hotspots, such as Bluetooth and USB.

3Facilitating Reporting and Auditing

No technology is infallible. The solutions that reduce mobile expense management costs will have reporting and auditing provisions. These modules allow humans to review overall trends to see where cost-cutting is possible and flag cases that indicate malfeasance.

3.1Reporting in mobile expense management

The organization's app for mobile expense management should have a wide range of reporting options.

On a basic level, reports about expense management should be automatically generated weekly, monthly, and yearly.

Company leaders should also be able to create reports on an ad hoc basis, such as when they want to dig deeper into spending in a particular category or expenses from a department.

With this big-picture view, companies can notice anomalies that may indicate financial abuse. For example, the average sales representative averages US$500 in client lunches, but one sales rep consistently has a US $1500 in the same category, with no discernible impact on closed business.

This anomaly may indicate that the sales rep is abusing his client's food and entertainment allowance.

3.2Reporting in MDM solutions

MDM solutions also need robust reporting and auditing mechanisms, given that company-issued phones are frequently used for non-work purposes, driving up mobile expenses.

AirDroid Business has some of the market's most robust reporting and auditing features. They can view data usage reports for the last day, month, or year. They can also deep dive to view the details of a particular device or zoom out to view significant picture trends, such as the top ten most data-intensive apps.

With these data points, companies can better manage their mobile expenses. If a company determines that social media is the most data-intensive app, it can consider banning it so it doesn't add to bandwidth costs.

4Getting A Solid Grasp on Your Mobile Expenses

The shift of work from on-site, office-based configurations to remote and hybrid setups is not only challenging operationally. Organizations must contend with a proliferation of business expenses that must be first paid for by employees.

Without the proper tools, organizations can quickly rack up astronomical mobile expenses. These costs can include non-work expenses passed off as official business and costs related to company-issued devices, such as high bandwidth or roaming fees.

To develop the best expense management processes, companies need two solutions: an app for mobile expense management like Expensify and an MDM like AirDroid Business. The rationale for the first is obvious: Employees need to track, process, and report mobile expenses in real-time and on the go, so they can focus on what matters the most: their work.

Leave a Reply.