Best 9 Money Apps for Kids and Teens

Remember the days of piggy banks and jingling coins? Our parents did a pretty job of equipping us with financial literacy. It is time to reciprocate and do the same for the kids. The good news is you do not have to go the route of piggy banks. Apps and budgeting tools make the process more seamless. However, choosing the best money app for kids is daunting, considering the many options available. This post provides a curated list of our top 9 money apps for kids and teens.

List of Best Money Apps for Kids and Teens

Without further ado, let's get started with our top picks:

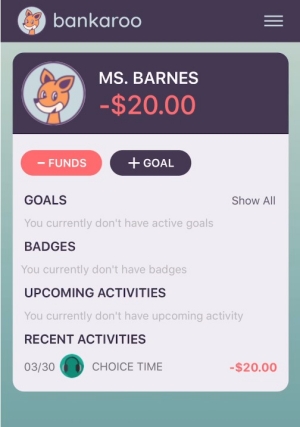

1Bankaroo

Bankaroo is more than a money app; it is a virtual bank for children. Moreover, it is available through the web and mobile app, which offers better flexibility. This FREE money app for kids enables you to have an overview of your child's financial decisions and track their savings goals.

Key Features:

- Parental Control Dashboard: On Bankaroo, you are able to directly edit your kid's account to set an allowance, add funds, set a new financial goal, and more.

- School Curriculum Alignment: Bankaroo fits with financial literacy in the school's curriculum, making it a great tool for home and classroom learning environments.

Recommended Age: 5-14 years old

Pricing: Free to use; $5/lifetime for the family edition with up to 6 kids

Compatibility: iOS (Note that I tried to use its Android version, but I couldn't find it on Play Store.)

2iAllowance

Are you looking for a kid-friendly money app to build financial responsibility in your children? iAllowance is undoubtedly a top one. It helps parents equip their kids with the tools and knowledge for building healthy financial habits. With it, you can assign chores to your child, link them to rewards, and track the completion of these chores.

Key Features:

- Automated Allowances: Features virtual banks with scheduled automatic deposits into your kid's accounts.

- Reward System: Allows you to link rewards to chores

- Multiple Bank Options: You are able to create separate accounts for different purposes.

Recommended Age: 7-10 years

Pricing: $2.99 - one-time purchase fee

Compatibility: iOS

3Savings Spree

Next on our list of money management apps for young children is Savings Spree. This app uses gaming elements to educate children on the fundamentals of finances, such as savings and spending, making choices, and earning and budgeting.

Key Features:

- Game-centric Learning Approach: Saving Spree teaches financial literacy using an engaging game, which makes the learning process fun for kids.

- Offers Interactive Scenarios: The app offers children real-world scenarios where they must make choices that affect their in-game finances.

Recommended Age: 5+

Pricing: $5.99 - one-time purchase fee

Compatibility: iOS

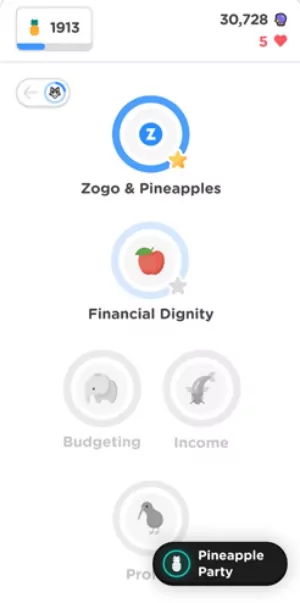

4ZoGo

When you think of the best money apps for teens to offer educational content, ZoGo ranks high among the options available. This app takes financial literacy to another level, focusing on financial learning. So, this app is also great for teachers to start discussions about personal finance with students.

Key Features:

- Incentive Reward System: Zogo works by rewarding users for learning using the Pineapple reward system. These rewarded Pineapples can be redeemed for gift cards and more.

- Multiple Learning Options: It offers different learning activities for different kids, such as interactive quizzes, engaging games, and more.

- Modules with Real-World Examples: It boasts more than 800 modules and a wide range of finance topics, allowing users to connect the financial topics with the real world.

Recommended Age: 16+ (As the user's ID is required.)

Pricing: Free

Compatibility: Android and iOS

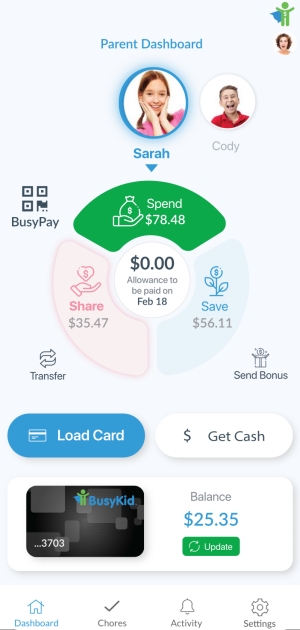

5BusyKid

BusyKid is considered the best chore app for kids. As a parent, you can send daily cash to your kid's account for completing chores. Apart from that, this mobile app combines investing, donating, saving, and debit cards, helping kids develop a better appreciation for money.

Key Features:

- BusyKid Spend Cards: You can own and fund 5 debit cards for spending by your kids.

- Flexible Chore System by Age: BusyKid provides a chore chart where the chores and allowance are preset by the age of the child. Meanwhile, parents can customize these chores.

- Charitable Donations: This app works with a growing list of charities so your child can donate their allowance to these charities.

- Investing: BusyKid allows just $10 as a minimum for an investment to let your child start their investing journey.

Recommended Age: 7+

Pricing: A 30-day free trial; $4/month

Compatibility: Android and iOS

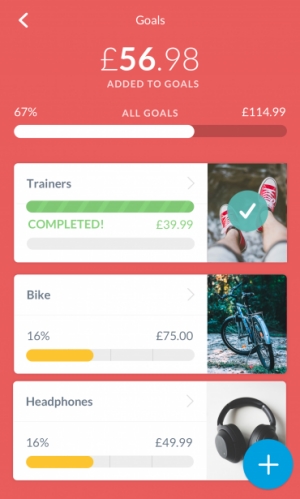

6Rooster Money

Planning to raise money-wise children? Rooster Money is one of the top money management apps for kids you may need. From pocket money to making real-world purchases, the app equips your kids with everything they need to know about responsible finances, such as savings, giving, and spending.

Key Features:

- Chore Manager: It allows you to assign and track chores and link them to rewards, which can be used to earn money.

- Optional Rooster Card: You can upgrade your child's account to a prepaid card for real-world transactions. Eligibility criteria and fees apply to this feature.

Recommended Age: 7+

Pricing: Free for basic features; $2.99/month and $18.99/year for full features

Compatibility: Android and iOS.

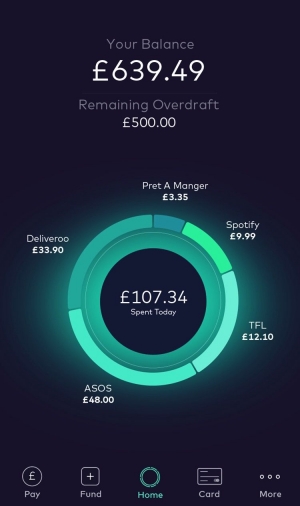

7Starling Bank

Starling Bank could be a solution if you're looking to help your kids manage their pocket money and turn their spending into skills. This FREE kid debit card system lets you set daily spending limits, lock harmful payments, receive instant notifications when your child spends, and more.

Key Features:

- Powerful Spending Insights: It uses graphs, streaks, and bar charts to be clear at a glance. It also classifies all your child's spending into different categories.

- Safe Card Environment: Your kid cannot use the Kite debit card in age-inappropriate places, including pubs, nightclubs, and gambling.

- Authenticated Payment: When your child's payment needs authentication, it will flagged. And you have the option to refuse this payment.

Recommended Age: 6-15 years old

Pricing: Free

Compatibility: Android and iOS

8Till

Thinking of how to help your kid build responsible spending habits? Till is designed to give kids the freedom to focus on spending savvy, not paying fees. With tools for managing finances and a prepaid debit card to go with it, your child is set to start a good money management lesson right away.

Key Features:

- Interest on Saving: You, as a parent, have the option to add a custom interest rate on saving balances, which boosts your child's savings.

- Auto Weekly Allowance: You can set a fixed allowance to "auto-pilot" once a week.

- Direct Deposit: If your teens are working to earn money, they can directly get their salary from their employer through the Till debit card.

Recommended Age: 8+

Pricing: Free

Compatibility: Android and iOS

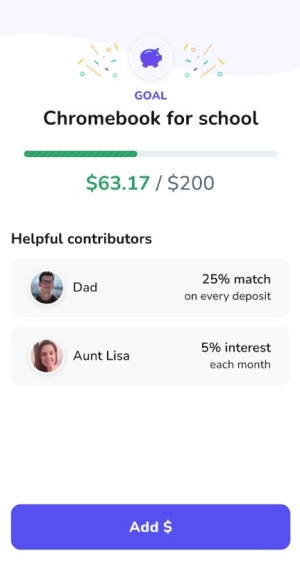

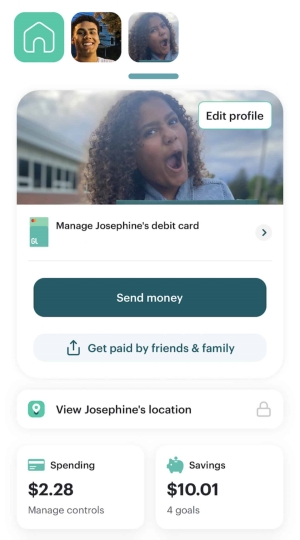

9Greenlight

With Greenlight, you can provide your kids with tools for financial literacy and personal safety. The app equips your children with skills for basic money management, such as budgeting, spending wisely, saving, and investing.

Key Features:

- Investment Opportunities: The app allows you to introduce your kids to the world of investment with age-appropriate options.

- Built-in Safety Tool: Greenlight also boasts features to ensure your family’s safety, such as location sharing, SOS alerts, and cash detection.

Recommended Age: 7+

Pricing: $4.99 - $14.98 depending on different plans

Compatibility: Android and iOS

Benefits of Using Money Apps for Kids and Teens

Now, you can choose your preferred money app for your little ones. After applying one to use, you may reap these benefits:

Enhanced Financial Responsibility

Money apps help children build financial habits early. They can easily budget, have saving goals, and track their expenses at a younger age. This will help them to develop money management abilities at a young age and grow into a financially responsible adult.

Increased Self-esteem and Confidence

As kids earn rewards and attain savings goals, they develop a sense of accomplishment, which can improve their self-esteem and confidence. Additionally, managing their finances personally can increase a sense of responsibility, which will help them to make informed decisions.

Better Goal Setting and Planning

Most money apps let children see their progress as they achieve savings goals, which can be highly motivating. The budgeting features in these apps can also help kids to think more about their future financial needs and plan appropriately.

Other Ways to Help Your Child Manage Money

In addition to the aforementioned, let's look at other ways you can help your child manage their money.

Discuss Needs Versus Wants

It is important to help your child understand the difference between needs and wants. Needs should always take precedence over wants.

Let them know that needs are essential items required for survival and well-being, such as food, clothing, and shelter. Wants, on the other hand, are desires that improve comfort and enjoyment, such as gadgets, games, and new toys.

Explain How Money Is Earned

Have open discussions with your children about how money is earned. Let them know that they must give value to receive money. Jobs and work are ways to earn money, and when you do your job well, you earn money.

Encourage Them to Earn Money

Beyond giving your children allowances, encourage them to earn money in different ways. These can include helping neighbors with simple tasks to earn money, organizing garage sales, or earning money through their skills. You can also let them do extra chores for rewards.

Incentivize Saving with Rewards

Motivating your child to save is a great way to build a saving culture in them. You can offer a reward based on achieving their savings goals. Another way you can incentivize saving with rewards is to celebrate saving milestones with rewards.

Set a Goold Example

Children learn more by observing what their parents do or do not do. Therefore, lead by example through demonstrative responsible financial habits. Let your actions speak louder than your words. Talk to your kids openly about your financial decisions. Prioritize savings and avoid impulse buying.

Improve Digital Safety While Using Money Apps

Without a doubt, money apps for kids have several benefits. However, as a parent, keeping your kid's digital safety is a priority. So, to improve your child's digital safety while using money apps, AirDroid Parental Control comes to help.

Leave a Reply.